Luxury & Collection

Watch Investment

Worth What Experts Say?

Why Collecting Rolex or Patek Philippe Watches

remains away from recession

That would be quite difficult to figure out a more catastrophic roller-coaster ride for investors than years 2020 and 2021. The Covid-19 issue affected most of us like the Great Recession and the usual investment have now been compressed into more than 15 months. But one could learn from the past and if 2008 is considered and experienced as a crash for most of investors, there are niches for which the “recession” was not lived as such… at all.

Predicting the future is a risky activity but can be controlled though.

If the S&P 500 dropped over 33% in March, as mentioned in the specialized press, plus a presidential election going berserk, and, more objectively a global never-ending pandemic going worse, I still keep optimistic and comfortable about one business: collectable watches.

Wise investors could assess that 2020 proved that at this precise moment, the market is everything but predictable, so let’s withdraw and look at what will come…”. Well, I would rather say “Where could I put my money in order not to be an effect of the situation.

Investing in the long term with a collection watches portfolio, advised by international expert and verifying the investment balance from time to time – which just means being in close contact with the expert – shall be a good advice, not to say one of the best at this moment.

Keeping your assets in the “hot stocks” or usual or investment trends would for sure be hazardous but what if, like in 2008, investing in watches would still keep your investments in a 50 to 60% growth? Well that’s what happened and still happening since the beginning of the Covid-19 pandemic.

It has been proven and still can be verified – and thus impossible to ignore – that the high end watches value trends impacted smart investors in 2020. Add to this beginning 2021 “Patek Philippe Nautilus 5711” raised from more than US$65k up to almost US$100k for the sole reason Patek Philippe announced the end of production for this reference and you will have an idea about such prosperous market. The key word here is “rarity”. And this is precisely what this market is surfing on since more than 25 years now.

Impressive price raise after Patek Philippe announced end of production fr this reference.

Two different markets can be identified: the “unavailable” models market, which is to say Rolex (or any other “rare birds” brand) announces at least 5 years before having any chance to have the wanted reference over your wrist, and the collection or vintage market. This latter is of course more proven on the long term and we will take that one as an example below.

Here are the top watch investment trends that may affect your portfolio to a consequent extent.

Rolex - Keeping the Throne

Rolex has always been, and will always be, on top of the world as far as collection watches are concerned. From the beginning of “Collection Watches Eldorado” up to now, the crowned watch manufacturer has always set the records in auction houses such as Christie’s, Sotheby’s or Phillips. If Antiquorum auction house had the merit to literally create such market, the above auction houses did not take long to follow the movement and set real “strike it rich” records for their clients. But let’s point out real examples and separate each brand into their best-sellers models and references.

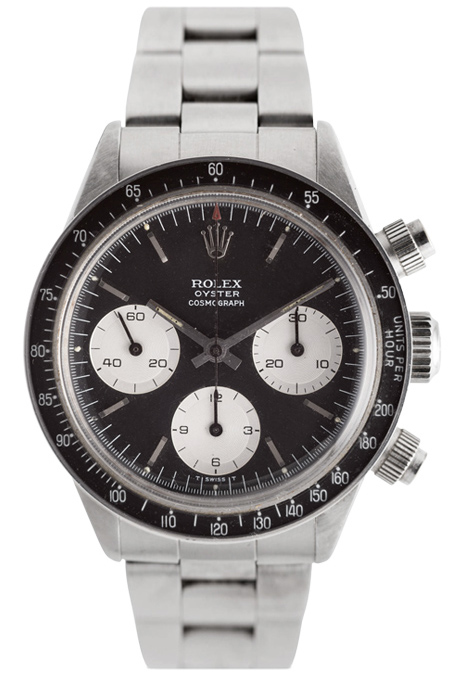

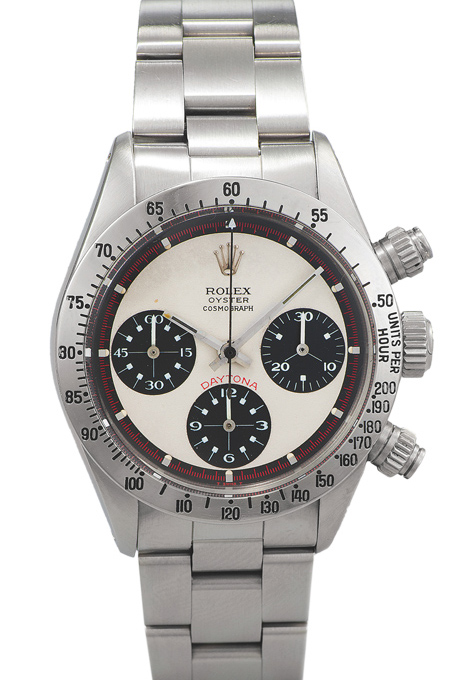

Rolex Daytona collection references

Ref. 6239

Ref. 6240

Ref. 6241

Ref. 6262

Ref. 6264

Ref. 6263

Ref. 6265

At the date of its first release and for more than 20 years, this watch has been shunned, shall we say, by most of Rolex’ clients. This only in early 90’s that rose an interest for such model. Such interest came from collectors and, not the least important data, through the first watches auctions initiated by Osvaldo Patrizzi and Co (Antiquorum Auction Company).

In 1990, just to name a few within the Rolex collection, hammer prices were on an average of:

Prices around year 1990

Rolex Cosmograph Daytona 6239 US$3,000

Rolex Cosmograph Daytona 6240 US$4,500

Rolex Cosmograph Daytona 6241 US$4,000

Rolex Cosmograph Daytona 6262 US$3,500

Rolex Cosmograph Daytona 6264 US$4,000

Rolex Cosmograph Daytona 6263 US$4,000

Rolex Cosmograph Daytona 6265 US$4,000

Prices 10 years later…

Rolex Cosmograph Daytona 6239 US$13,000

Rolex Cosmograph Daytona 6240 US$16,000

Rolex Cosmograph Daytona 6241 US$14,000

Rolex Cosmograph Daytona 6262 US$13,000

Rolex Cosmograph Daytona 6264 US$15,000

Rolex Cosmograph Daytona 6263 US$17,000

Rolex Cosmograph Daytona 6265 US$15,000

Around 2008 crisis, no recession effect

Rolex Cosmograph Daytona 6239 US$29,000

Rolex Cosmograph Daytona 6240 US$33,000

Rolex Cosmograph Daytona 6241 US$31,000

Rolex Cosmograph Daytona 6262 US$29,000

Rolex Cosmograph Daytona 6264 US$32,000

Rolex Cosmograph Daytona 6263 US$32,000

Rolex Cosmograph Daytona 6265 US$30,000

Middle of Covid-19 recession…

Rolex Cosmograph Daytona 6239 US$60,000

Rolex Cosmograph Daytona 6240 US$90,000

Rolex Cosmograph Daytona 6241 US$75,000

Rolex Cosmograph Daytona 6262 US$65,000

Rolex Cosmograph Daytona 6264 US$70,000

Rolex Cosmograph Daytona 6263 US$85,000

Rolex Cosmograph Daytona 6265 US$75,000

When featuring a Paul Newman dial, Rolex Cosmograph Watches reach different prices…

1990 US$20,000 to 30,000

2000 US$45,000 to 60,000

2010 US$100,000 to 150,000

2021 US$200,000 to 500,000 and above

One must understand that for a new watch, purchased in a Rolex authorized dealer shop is usually equivalent to today’s US$13,000, considering inflation of any given date. The only factor to take into consideration being a rise of prices of about 6% per year on new watches. The difference between second hand and new Rolex Daytona watches is a demonstration of what I would call a worth investment.

Patek Philippe - Rarity Makes You Stronger

Patek Philippe is little different compared to a luxury, but industrial watch manufacture. The production ratio is Patek manufacture around 14X less watches than Rolex per year and you can imagine what would be the potential of availability for a “hard to get” sport watch from Rolex compared to one from Patek Philippe. Another difference would be the “Daytona effect” versus the “Nautilus effect”. When Rolex announced that the Rolex Daytona 116520 was not produced anymore and that ne reference “116500” was released, everyone jumped on the new reference. Which made it hard to obtain immediately from Rolex but rather easy from the second-hand market. As a result, the new 116500 for which retail price is 13,600US$ is available on the second-hand market for 25,000US$… But when Patek Philippe announces that they won’t produce the Nautilus 5711 anymore, the public does not wait for the new reference… it just makes the second-hand market 5711 prices raise up to 1.5X.

But the Patek Philippe 5711 is very far from being the collection watch Must-Have. This is just a rarity effect and thus will remain as such but there are more collectable watches from the brand. Finding a Nautilus 3700 or 3712 in good condition and featuring all the original parts is another kind of sport, and another kind of price.

Vintage chronographs are now breaking the auction sales records to an extent no one could have imagined.

Let’s take a look at some of them, based on an average of important auction houses results…

Patek Philippe 3700 Steel

2010 $20,000

2015 $60,000

2021 $140,000

Patek Philippe 3712

2000 $30,000

2010 $55,000

2021 $110,000

Patek Philippe 2499

2000 $300,000

2015 $600,000

2020 $800,000

Patek Philippe 2526

2000 $18,000

2010 $30,000

2021 $60,000

Audemars Piguet - One Model Makes It All

Audemars Piguet is an old Swiss manufacture, offering high end watches, almost everyone knows that… What we also know is even though they worked hard to diversify their product, fame came in when the first Royal Oak model was released in 1972 at the Baselworld fair. Both the President of Audemars Piguet and Gerald Genta, the designer of this iconic watch had a stroke of genius. Asking a new and totally different watch to Gerald Genta, giving him carte blanche for the design and allowing him 24H to do so is the first genius idea. The second genius stroke goes to Gerald Genta who definitely had divine inspiration. Not only this model will become the iconic reference of Audemars Piguet, but it will make the brand hold the top five luxury brands until now.

Once again, history shows that magical events repeats themselves at least twice, usually 30 to 40 years from the first event. And it happened to Audemars 48 years later… If Audemars Piguet was not part of the big league of sales records, maybe except for chronograph from the 50’s which are so rare you could not find one anymore, the Royal Oak helped to do so. In 2020, all collectors suddenly rushed on the first reference of the model, the 5402. of course, within less than a month, all “NOS” watches were sold out. But what usually happens in that case, and the “Royal Oak” is the perfect model for that, is everyone rushed on other references, Quantieme Perpetuels, Skeletons, smaller diameters, almost everything… Thus, the Royal Oak is now, and will be for a long time, part of the Big League of most sought after collection watches. The future of such watch is now secured for a long time, one of the main reason being it has proven it can be part of the top 5 and, the watch being fragile (thin case), it will be really rare to find one in good condition in 10 or 20 years and above.

Compared to 2010, the 5402 Royal Oak of Audemars Piguet raised from US$12.000 to US$100.000 in 2021… (Picture Courtesy Antiquorum Auctions)

F.P. Journe - An Example of The Rise of Independent Watchmakers

A good but not least investment, reserved to those who are ready to put some money on so-called “watch capital risk”, remains in the field of independent watchmakers. As Philippe Dufour or Gorge Daniels, Francois-Paul Journe (F.P. Journe Watches) became on of the first independent to break records at Phillips, Christie’s or Sotheby’s. In this case, this is just a matter of patience and passion. Compared to 2010, the F.P. Journe watches prices raised from US$50.000 to US$350.000 in 2021 for some references.

Predicting such phenomenon is a matter of knowledge, a little bit of chance and intuition. One could say well let’s take a couple of independent watchmakers model and wait… But it can be risky as not all independents watchmakers have the same skills and talent. Moreover, some of them are definitely ne keen to be part of the big game of watchmaking industry. I think talented independent watchmaker should know the rules of marketing although I definitely respect those who only want to please very specific clients and produce 10 or 20 watches per year.

F.P. Journe is a good example of how to buy watches which will break records in the future. He is a very talented watchmaker, this is undeniable, first trump card. When he has developed a reference, he produces it different materials, usually yellow gold, white gold, rose gold and small amount of platinum serie. This late factor is very important. He decides that the best diameter for the reference’s design must be smaller than the usual 40mm, 38mm is this case… Five years later, the diameter is modified… 40mm. At that time, those who rushed on the second hand 38mm platinum models and waited a little bit really “stroke it rich”…

Though F.P. Journe represents a worth investment for the coming years, he is not the only skilled independent watchmaker… (Picture Courtesy Chrisities Auctions)